Get professional guidance on buying bitcoin, self-custody and inheritance planning from a qualified Bitcoin Mentor.

Bitcoin, the world’s first decentralized digital currency, offers unparalleled financial freedom.

However, with that freedom comes responsibility. One of the most critical decisions you’ll make as a Bitcoin owner is how to store it.

While leaving your Bitcoin on an exchange or with a third-party custodian might seem convenient, it comes with significant risks.

Self-custody—taking control of your own Bitcoin—is the best way to ensure its security and align with the ethos of decentralization.

Why Self-Custody Your Bitcoin?

Not Your Keys, Not Your Coins

When you store Bitcoin on an exchange or with a third-party service, you don’t truly own it—you’re trusting someone else to hold it for you.

History is littered with examples of exchanges being hacked, mismanaged, or outright disappearing with users’ funds.

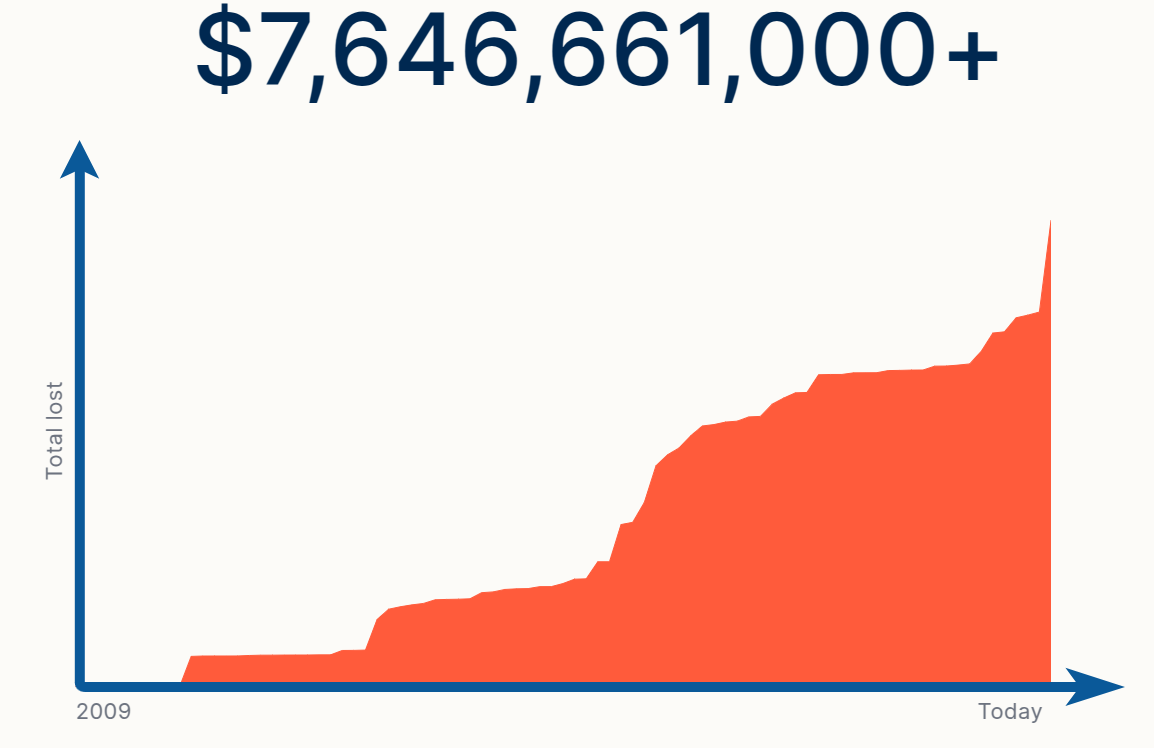

As of today, there are a total of 50+ hacking events, with lost funds amounting to a total of approximately $7.6 billion.

Think Mt. Gox in 2014, QuadrigaCX in 2019, or the collapse of FTX in 2022.

This Netflix movie on QuadrigaCX that will scare you into self custody.

Self-custody eliminates this counterparty risk by giving you direct control over your private keys, the cryptographic codes that prove ownership of your Bitcoin.

Protection Against Censorship

Bitcoin’s promise lies in its resistance to centralized control. Governments or financial institutions can pressure exchanges to freeze accounts, seize funds, or comply with restrictive regulations.

By self-custodying your Bitcoin, you ensure that no one can arbitrarily restrict your access to your wealth.

Financial Sovereignty

Self-custody aligns with Bitcoin’s core philosophy: empowering individuals to be their own bank.

When you hold your own keys, you’re not reliant on intermediaries. You can send, receive, or hodl your Bitcoin without permission from anyone.

Long-Term Security

Exchanges are prime targets for hackers due to the massive amounts of Bitcoin they hold.

Even well-meaning custodians can suffer breaches or insider theft. Self-custody, when done correctly, lets you secure your Bitcoin in a way that’s tailored to your needs, reducing exposure to systemic vulnerabilities.

Risks of Self-Custody

Before diving into the “how,” it’s worth acknowledging the trade-offs. Self-custody shifts the responsibility onto you.

If you lose your private keys or seed phrase (more on that later) and don’t have a backup, your Bitcoin is gone forever—no customer support can save you. Similarly, poor security practices could expose your funds to theft.

But with proper precautions, these risks are manageable, and the benefits far outweigh the downsides.

How to Self-Custody Your Bitcoin

Here’s a practical guide to taking control of your Bitcoin. This process assumes you already own some Bitcoin and want to move it to your own wallet. If you want to buy Bitcoin, check out a Bitcoin only exchange like Bull Bitcoin.

Step 1: Choose a Wallet

Bitcoin wallets come in two main flavors: software (hot) and hardware (cold). Your choice depends on your needs for security and convenience.

Software Wallets (Hot)

These are apps or programs that run on internet-connected devices like your phone or computer. Examples include Electrum, BlueWallet, or Sparrow Wallet. They’re free, easy to set up, and great for small amounts or frequent transactions. However, since they’re online, they’re more vulnerable to hacking or malware.Hardware Wallets (Cold)

These are physical devices designed to keep your private keys offline, offering top-tier security. Popular options include Ledger Nano, Trezor, and Coldcard. They’re ideal for larger amounts or long-term storage. A hardware wallet typically costs $50–$150 but is worth the investment for peace of mind.

For a complete list of Bitcoin Wallets, see my list on this page near the bottom.

For most people, a hardware wallet is the gold standard for self-custody.

I’ll focus on that method here, but the principles apply to software wallets too.

Step 2: Purchase and Set Up Your Hardware Wallet

Buy directly from the manufacturer to avoid tampered devices.

Once it arrives, follow the setup instructions. You’ll typically:

Connect the device to your computer or phone.

Install the companion software

Generate a new wallet on the device.

Step 3: Back Up Your Seed Phrase

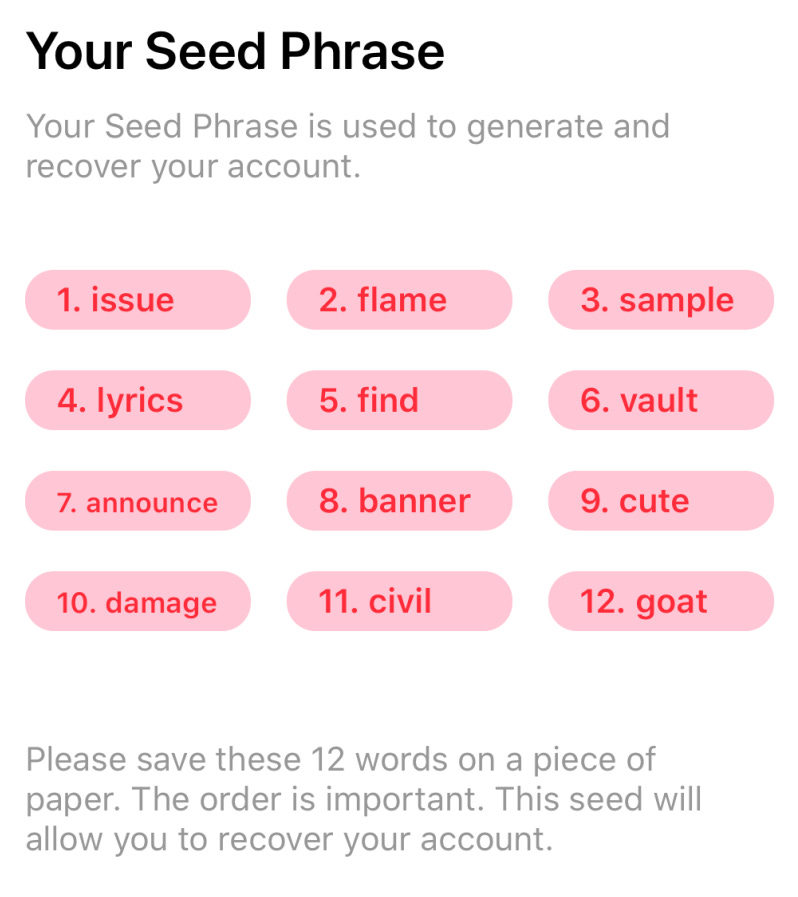

During setup, your wallet will generate a 12- or 24-word seed phrase (also called a recovery phrase). It looks like this.

This is the master key to your Bitcoin.

Write it down on paper or engrave it on metal (e.g., using a steel plate like a Billfodl).

Never store it digitally—screenshots, cloud storage, or text files can be hacked.

Keep it in a secure, private location (e.g., a safe or safety deposit box). Some people split it across multiple locations for added redundancy.

If your hardware wallet is lost or damaged, the seed phrase lets you recover your Bitcoin on a new device.

Guard it with your life.

Step 4: Transfer Your Bitcoin

Open your exchange account and locate the “Withdraw” or “Send” option.

On your hardware wallet’s software, generate a Bitcoin receiving address (a long string starting with “bc1” or “1”).

Copy the address carefully (or use a QR code) and paste it into the exchange’s withdrawal field.

Double-check the address—mistakes are irreversible.

Send a small test amount first (e.g., $10 worth) to confirm it works, then transfer the rest.

Step 5: Verify and Secure

Confirm the Bitcoin arrives in your wallet by checking the balance on the device or software.

Store your hardware wallet in a safe place (not plugged into your computer 24/7).

Optionally, set a strong PIN or passphrase on the device for extra protection.

Step 6: Test Your Backup (Optional but Recommended)

Reset your hardware wallet and restore it using your seed phrase to ensure you’ve recorded it correctly. Do this before trusting it with large amounts.

Best Practices for Self-Custody

Keep It Private: Never share your seed phrase or private keys with anyone—not even friends, family, or “tech support.”

Stay Offline: Use hardware wallets or air-gapped devices for maximum security.

Diversify Storage: For significant holdings, consider a multi-signature (multisig) setup, where multiple keys are required to spend funds.

Stay Educated: Bitcoin tech evolves—keep learning about new tools and threats.

Conclusion

Self-custodying your Bitcoin is about reclaiming control and embracing the responsibility that comes with true ownership.

While it requires effort and diligence, the peace of mind and security it provides are unmatched.

In a world where centralized systems can fail or turn against you, self-custody is the ultimate expression of Bitcoin’s promise: financial independence.

Start small, practice the process, and scale up as you gain confidence.

Your Bitcoin is yours. Keep it that way.

Not your keys, not your coins 🫡