Dear On Bitcoin Readers (and Moms and Dads),

This letter is not just to my parents but maybe to your parents or perhaps you are the parent.

Either way, I just wanted to tell you about why Bitcoin is the Hardest Money Since Gold and why you should hold some Bitcoin.

I’ve watched the world change in ways you, my Baby Boomer parents, could hardly have imagined when you were raising me.

From the internet to smartphones, technology has reshaped how we live and now, it’s reshaping money itself.

I know you’ve heard me mention Bitcoin before, probably with a skeptical raise of the eyebrow.

You’ve lived through the gold standard, stagflation, and countless economic ups and downs, so I get why “digital money” sounds like a risky fad.

But hear me out.

Bitcoin isn’t just another crypto token.

It’s the hardest money we’ve had since gold, and I believe it’s a powerful way to protect your wealth for the long term.

Let me explain it in a way that makes sense, from one generation to another.

What Is Bitcoin, Anyway?

Think of Bitcoin like the gold you used to talk about, Dad, when you’d explain how the dollar was once backed by something real.

Bitcoin is digital gold, a currency that no government, bank, or corporation can control.

It was created in 2009 by someone (or a group) called Satoshi Nakamoto, with a radical idea: money that’s scarce, secure, and free from meddling.

It runs on a global network of computers, not a central bank, so no one can just “print” more of it.

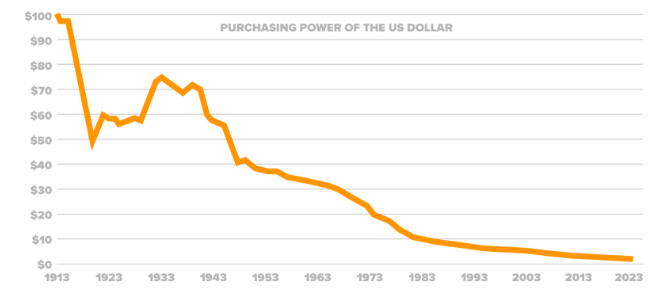

You’ve seen how the dollar’s value has eroded over your lifetime.

Remember when a cup of coffee cost 25 cents?

That’s inflation at work.

Bitcoin is designed to fight that, and here’s why I think it’s worth your attention.

Why Bitcoin Is the Hardest Money Since Gold

No Printing Press Allowed

Bitcoin has a hard cap of 21 million coins, period.

Unlike the dollars in your savings account, which lose value as the government prints more (and boy, have they printed a lot!), Bitcoin’s supply is fixed.

You lived through the 1970s, when inflation hit double digits and your savings didn’t stretch as far.

Since the U.S. left the gold standard in 1971, the dollar has lost over 80% of its purchasing power.

Bitcoin’s scarcity makes it a shield against that kind of erosion, just like gold was back in the day.

No One Can Mess With It

Mom, you’ve always been wary of banks and their fees, and Dad, you’ve got stories about government policies that didn’t exactly inspire trust.

Bitcoin is decentralized, meaning it’s not controlled by any one entity.

It lives on a system called the blockchain, a digital ledger verified by thousands of computers worldwide.

No bank can freeze your account, and no government can seize it without your private key (think of that as the key to your safe deposit box).

For you, who’ve navigated financial systems for decades, this kind of independence is huge.

Easy to Store and Move

I know you’ve got some gold coins stashed away, Dad, but they’re heavy, hard to move, and not exactly practical if you need to send money across the country.

Bitcoin is digital, so you can store it on a small device, like a USB drive, or even stamp your seed phrase(password) on a steal fire proof plate.

You can send it to me or the grandkids in minutes, no bank required.

For you, who’ve dealt with the hassle of moving assets or wiring money, Bitcoin’s simplicity is a breath of fresh air.

It’s Proven Itself

Bitcoin’s been around for over 15 years now, surviving crashes, skeptics, and even government crackdowns.

When I first bought some, it was worth about $500 per coin. Today, as of July 2025, it’s around $118,000.

Yes, it’s up and down in the short term, more on that later, but over the long haul, it’s held value better than most assets.

For you, planning for retirement or leaving something for the family, that’s worth considering.

Why Not Other Cryptocurrencies?

I know the news throws around terms like “crypto” and you’ve heard of things like Ethereum or Dogecoin.

Most of these are like tech startups, some are interesting, but many are speculative or controlled by small groups who can change the rules.

Bitcoin is different.

Its rules are locked in, its supply is capped, and it’s built to be a store of value, not a tech experiment.

It’s the only cryptocurrency I’d feel comfortable explaining to you, because it’s the only one designed to act like gold.

Why This Matters to You

You’ve both worked hard to build a nest egg, and I know you worry about what inflation will do to it.

Since 2000, the dollar’s purchasing power has dropped by about 50%. That means your savings buy half what they used to.

Meanwhile, Bitcoin’s value has grown because it’s scarce and trusted by millions globally.

It’s not about “getting rich quick” (I know you’d roll your eyes at that, Mom).

It’s about protecting what you’ve got from a system that keeps devaluing our money.

Think back to the 1970s, when gas lines and soaring prices made life tough.

Today’s money printing is even crazier—trillions of dollars created out of thin air. Bitcoin is my way of saying, “Enough.”

It’s a hedge against a system that’s not looking out for us, and I want you to have that protection, too.

How to Get Started (Without Losing Sleep)

I can see you raising your eyebrows, wondering if this is too complicated or risky. I get it, new tech can feel overwhelming.

But it’s not as hard as it sounds, and I’ll help you every step of the way. Here’s how to dip your toes in safely:

Start Small

You don’t need to buy a whole Bitcoin—it’s divisible, like cents to a dollar. Start with $100 or whatever you’re comfortable with, just like you’d buy a few shares of stock.

Use Trusted Platforms

I’d recommend Bitcoin only exchanges like Bull BItcoin or Bitcoin Well. They’re user-friendly, regulated, and reputable. I can walk you through setting up an account.

Keep It Safe

Store your Bitcoin in a “wallet.”

A hardware wallet is like a digital safe, small, secure, and easy to use.

The Bitkey Bitcoin Wallet is a good option.

I’ll show you how to set it up.

Learn a Little

There’s a great book, The Bitcoin Standard by Saifedean Ammous, that explains this in plain English.

Or just ask me.

I’m happy to explain over coffee!

Watch Out for Scams

If someone calls promising “Bitcoin riches,” hang up.

Stick to reputable platforms, and never share your private keys.

A Note on the Rollercoaster

Yes, Bitcoin’s price can swing wildly.

One month it’s up, the next it’s down.

But you’ve seen this before. Stocks, real estate, even gold had volatile years.

Over time, Bitcoin’s trend has been upward.

For you, thinking about the next 10 or 20 years, those short-term dips matter less than the long-term protection against inflation.

Why I’m Telling You This Now?

Mom, Dad, you’ve taught me to plan ahead, to think about the future.

The dollar isn’t what it was when you were my age, and with governments piling on debt, it’s not getting better.

Bitcoin is my way of taking control, and I want you to consider it, too.

I’m not saying sell your bonds or empty your savings account.

Maybe just put 1-5% of your portfolio in Bitcoin, like you’d diversify with gold or real estate.

It’s a hedge, a safety net, for you and for us kids and grandkids.Wrapping UpBitcoin isn’t a fad or a get-rich scheme.

It’s the hardest money we’ve had since the gold standard. A way to protect your wealth in a world where the rules keep changing.

I know it sounds futuristic, but it’s really about going back to basics: money that holds its value, that no one can manipulate.

Let’s talk about it more.

Love,

Your Son

P.S. If you want to learn more, drop me a line or leave a comment.

I can point you to simple resources or walk you through it myself.

Let’s figure this out together!

Send this to someone who needs to read this. Maybe send it to your parents. ;)